The recent U.S. election results have significant implications for the fintech industry, potentially shaping policies that may redefine regulatory standards, data privacy, and the nature of bank-fintech partnerships. Here is an analysis of how these outcomes could impact fintech in 2025 and beyond, including insights from Eric Hannelius, CEO of Pepper Pay, on the opportunities that lie ahead.

- Potential Regulatory Adjustments and Flexibility.

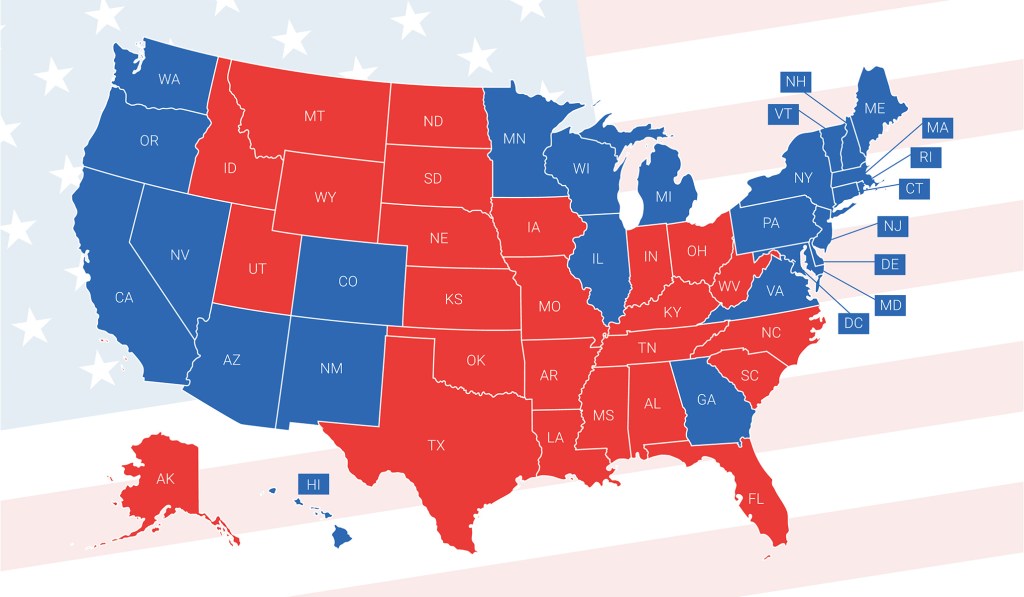

Under different administrations, the level of regulatory flexibility provided to fintechs can vary greatly. A Democratic administration, for example, might continue with strict regulatory oversight through bodies like the Consumer Financial Protection Bureau (CFPB), pushing for stronger consumer protections and higher compliance requirements for fintech firms. This oversight includes rules on data access under the CFPB’s new 1033 rule, designed to empower consumers with better control over their financial data. Alternatively, if a more deregulatory stance gains traction, as could happen under Republican leadership, we may see eased constraints on data-sharing regulations and greater encouragement for innovation in fintech services.

Eric Hannelius sees these shifts as part of the growing maturity of fintech: “Regulatory adaptation can be challenging, but it also pushes the industry to innovate responsibly, which ultimately benefits both consumers and companies.”

- Fintech-Bank Partnerships and Chartering Policies.

The election results also influence the dynamics between banks and fintech firms, especially in terms of partnerships and bank charters. In recent years, fintech companies have pursued bank charters to access new funding channels and offer banking services more seamlessly. However, a conservative shift in policy could encourage the expansion of special-purpose charters or the development of banking-as-a-service (BaaS) models that allow fintechs to leverage banking products without the need to directly become banks themselves. This move could encourage smaller fintech firms to expand without the full weight of bank-level regulation.

According to Eric Hannelius, these partnerships provide “a way for fintech companies to bridge gaps in financial access, making it easier for underbanked populations to engage with digital finance tools.”

- Data Privacy and Consumer Data Access.

Data privacy and security remain key issues, especially as consumers increasingly engage with digital banking platforms. With bipartisan support for consumer data protection, it is expected that regulations around data security and privacy will remain a priority, regardless of the political landscape. The rise in digital finance usage has emphasized the need for secure data-handling processes and transparent user data policies. Future policies could introduce stricter compliance requirements, including enhanced data encryption standards, which would prompt fintech firms to reinforce their cybersecurity measures.

Eric Hannelius stresses, “In an industry that relies heavily on trust, maintaining the highest standards of data privacy is an imperative. Trust drives customer loyalty, and it is the foundation upon which sustainable fintech growth rests.”

- Interest Rates and Economic Impacts.

Economic stability plays a role in shaping fintech’s trajectory. With a potential slowdown in interest rate hikes under certain administrations, consumer spending might stabilize, creating a more favorable environment for fintech lending and other financial services. In addition, economic policies that foster a stable or reduced interest rate environment could enable fintech companies to expand credit offerings to a broader segment of consumers.

Eric Hannelius believes this economic flexibility could “create an environment where fintech can offer products that are both competitive and accessible, serving a diverse range of customer needs.”

- Looking Forward.

The recent election outcomes provide fintech leaders with both challenges and opportunities. While regulatory adjustments may require careful compliance management, they also bring avenues for innovation and growth, especially in under-served markets. For fintech companies like Pepper Pay, navigating these changes with a forward-thinking strategy that balances innovation with responsibility will be essential. As Eric Hannelius notes, “In fintech, adaptability is a key. With the right approach, the evolving landscape will only enhance the ability of fintech firms to drive value and inclusivity in finance.”

These factors underline the ongoing need for fintech firms to stay agile and committed to customer-centric innovation while maintaining robust data security and compliance practices.